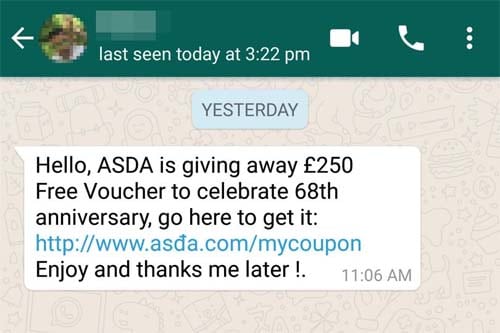

Most victims of similar scams in Singapore realise much later that they’ve been conned. You end up waiting for the promised money that never arrives. If you fall for this trick and transfer the deposit money, you’re in for a rude shock. You don’t receive the loan even after paying the deposit This is to convince victims they’re dealing with a registered licensed moneylender. To overcome your doubts, and to win your trust, the crooks will send another document confirming the loan approval. To convince you to pay, they send fake documents allegedly from the MAS or MinLaw. You’ll be asked to transfer some money as a deposit towards loan approval along with 7% GST. When you express a desire to borrow, these loan scammers begin the actual process of duping you. You are requested to cough up some deposit money first As long you have your SingPass and NRIC, they appear ready, even eager to help. To further reel you in, they go easy on documentation. They may go the extent of claiming to be a representative of a licensed moneylender. To lull your suspicion and prove they’re authentic, they sometimes link to a fake website. Loan scammers approach you on WhatsApp or send a SMS message offering a loan. You get a text WhatsApp message offering you an instant loan The first step to avoid becoming getting conned is to find out more about how they operate. These monetary scams in Singapore prey on vulnerable and cash strapped prospects.

How Does This Loan Scam in Singapore Work? They hope to prevent more of us from falling prey to this new loan scam.Īccording to the police, most of these scams are the handiwork of unlicensed moneylenders. This has prompted the Police and Ministry of Law (MinLaw) to issue a scam alert in Singapore to warn the public. The cases doubled to 692 for the same period in 2019, with losses reported at $2.2 million.

The victims lost $0.67 million between them. In the first half of 2018, 315 Singaporeans and foreign workers have been victims of this WhatsApp money lender scam. Calls to the Mr X went unanswered.Īfter two weeks, the loan still didn’t arrive. Things begin to unravel soon after she paid the money to the caller. It offered her a way out of the financial mess.Īfter a brief conversation with the lender (Mr X), and with no prior experience dealing with moneylenders, Sophie took him up on his offer.Īfter sharing her documents, Mr X asked her to pay a deposit towards loan approval. Sophie was stressing over her mounting credit card dues when she received a WhatsApp message. Find out how WhatsApp money lender scam works and how to avoid getting scammed with this guide.

0 kommentar(er)

0 kommentar(er)